22 Ways to Reduce Overhead Costs for Small Businesses

If you are a business owner, you are likely feeling the effects right now of the COVID-19-induced economic downturn and looking for creative ways to reduce overhead costs. Learn more.

If you are a business owner, you are likely feeling the effects right now of the COVID-19-induced economic downturn and looking for creative ways to reduce overhead costs. Learn more.

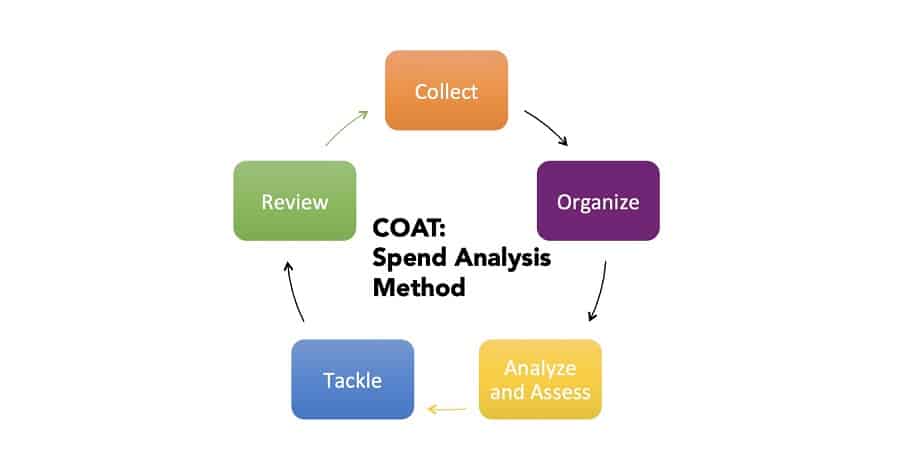

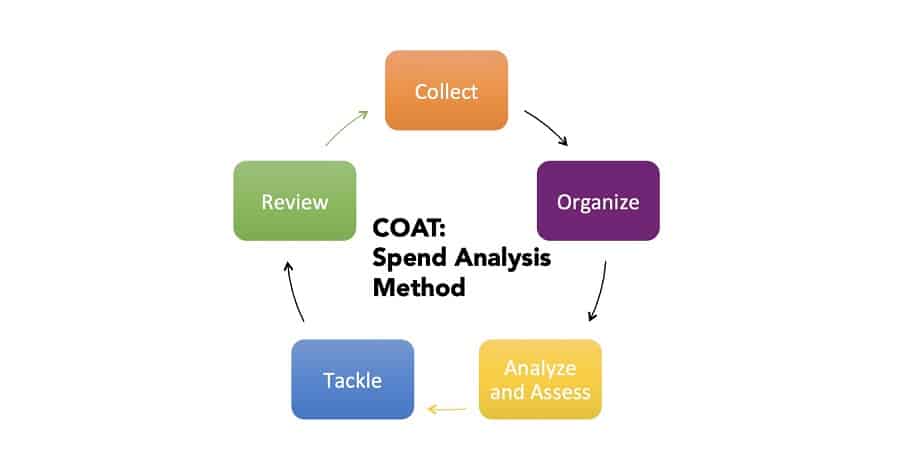

A spend analysis is a process to audit and understand all of your business expenses. We’ll show you how to conduct one and save money in this article.

If you find yourself wondering “where does the money go?,” it’s time to invest in a spend analysis. However, you might not know what a spend analysis is. This article is for you. Learn more.

Are you preparing your 2020 business taxes? We’ve prepared a general guide to remind you of the tax credits, deductions, and opportunities you should consider as you look back on the 2019 business year.

Hiring an expense consultant can help improve your company’s bottom line, but you likely have questions about the process. Learn about hiring one here.

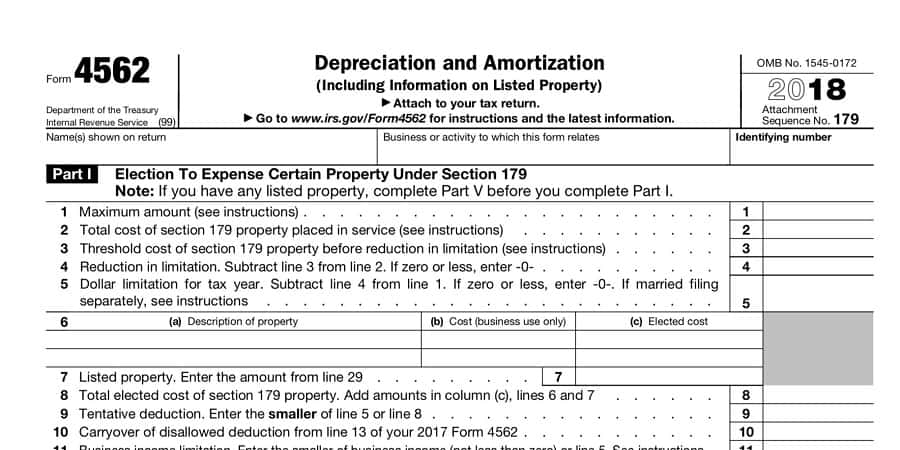

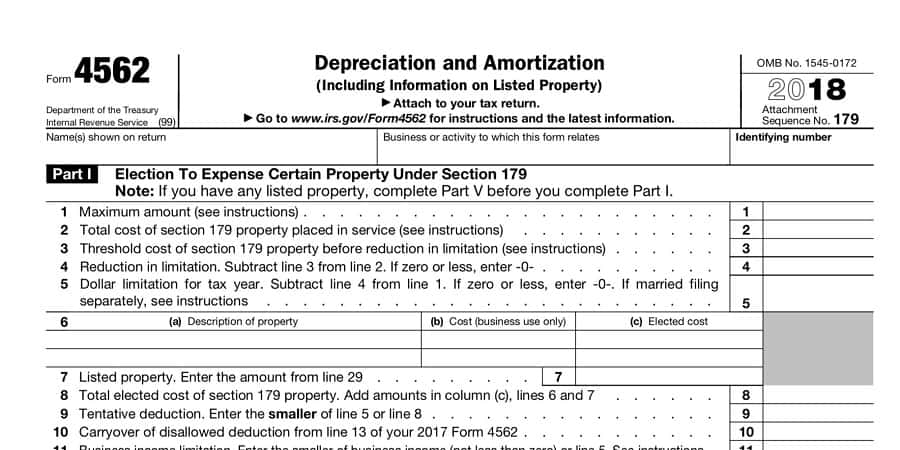

The IRS and the Treasury Department finalized new depreciation rules stemming from the Tax Cuts and Jobs Act (TCJA) in September 2019. Learn key takeaways about the changes here.

The cost of metered parking has gone up significantly in recent years as an unintended consequence to financial regulation. Find out what your business can do about it.

This year, the Federal ITC is offering 30% off of the cost of solar panel equipment installation, with additional cash benefits, which means your business can generate its own energy in 2019 and beyond. Find out more about the solar

Electric bills are one type of monthly payment where paying above-market rates can turn from pennies per kWh extra into thousands or hundreds of thousands of dollars more per year. Learn how we saved one client close to a million

Here we discuss the differences between an Accountant, CFO and Expense Reduction Consultant and how you can have each without overlap.

If you are a business owner, you are likely feeling the effects right now of the COVID-19-induced economic downturn and looking for creative ways to reduce overhead costs. Learn more.

A spend analysis is a process to audit and understand all of your business expenses. We’ll show you how to conduct one and save money in this article.

If you find yourself wondering “where does the money go?,” it’s time to invest in a spend analysis. However, you might not know what a spend analysis is. This article is for you. Learn more.

Are you preparing your 2020 business taxes? We’ve prepared a general guide to remind you of the tax credits, deductions, and opportunities you should consider as you look back on the 2019 business year.

Hiring an expense consultant can help improve your company’s bottom line, but you likely have questions about the process. Learn about hiring one here.

The IRS and the Treasury Department finalized new depreciation rules stemming from the Tax Cuts and Jobs Act (TCJA) in September 2019. Learn key takeaways about the changes here.

The cost of metered parking has gone up significantly in recent years as an unintended consequence to financial regulation. Find out what your business can do about it.

This year, the Federal ITC is offering 30% off of the cost of solar panel equipment installation, with additional cash benefits, which means your business can generate its own energy in 2019 and beyond. Find out more about the solar

Electric bills are one type of monthly payment where paying above-market rates can turn from pennies per kWh extra into thousands or hundreds of thousands of dollars more per year. Learn how we saved one client close to a million

Here we discuss the differences between an Accountant, CFO and Expense Reduction Consultant and how you can have each without overlap.