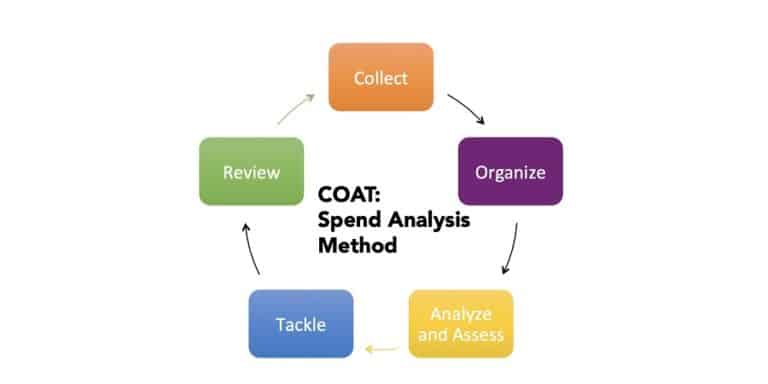

A spend analysis is a process to audit and understand all of your business expenses. The goal is to find opportunities to save money and prioritize where your dollars go. Last month, we published a blog post that dives into the definition in depth. This month, we’re going to give you some insight into what it takes to do a thorough and effective spend analysis. To do this, we use the COAT method.

Collect

The first step is to collect all the information you can about what you’re buying, how much it costs, who and how you’re paying and who and how it adds value to your organization. Start with accounting and move through your departments, offices and other places where the money is spent. Get that information into a single place where you can begin to work with the data.

You will probably have to work with whoever manages your accounting. You may need to work with your staff or department heads to be sure that you understand how each thing you’re paying for is used.

Take a systematic approach. Start with general overhead, such as office supplies, or payroll processing – anything that applies evenly throughout the organization. Next, gather information by business area or department. Be sure to note vendors and contract terms.

Your approach to organizing your data will depend on what kind of business you are in, and the specific structure you’ve built. A medical practice has a different type of supply chain than a hotel or restaurant. A product that is shipped through distributors will have a different expense structure than one that sells direct online. As you go, you may find there are better ways to structure your information.

It pays to get this information into a spreadsheet, database or purpose-designed software package. That will ensure the work you’re doing now is easily repeated and maintained. The more comprehensive and organized your analysis is now, the easier it will be to maintain in the future. The result will be long term confidence that your money is spent wisely.

Organize

This step is about ensuring that all the data you just collected is accurate and consistent. Some people refer to this as data cleansing. First, make sure you have consistent data, by making sure you create a structure for each expense. It should include items like product or service type, provider, amount, frequency of payments or deliveries, term of contract, primary user(s). Check for any errors, omissions or inconsistencies. Consult with the people using the services and materials to understand their value, quality of service, and more.

You’ll then want to organize your spending in two ways. The first grouping is by vendor. If you group purchases by vendor or provider you may find opportunities for savings. Purchases made from related entities, such as IBM, IBM Corp., or Cognos should all be grouped together since they’re all one company.

The second categorization is by type. You can come up with your own classification scheme, or use one of several standards for categorizing goods and services such as eClass or UNSPSC. These standards may be especially helpful if your business is large or deals with a complex set of materials or services.

Once you have a complete set of data, and you’re confident that it is accurate and consistent, you can start to assess and analyze.

Assess and Analyze

Now that you’re organized you can begin to assess and analyze. There are four things to be looking out for. Label each item.

1. Unnecessary Expenses

As time goes by, some products or services may no longer be used or needed. Consult with your staff to identify these. Set priorities on each expense so that you know whether it is essential or a nice to have.

2. Duplicate or overlapping expenses

It is often the case that different groups within an organization will have chosen different vendors for similar services or materials. This is especially true if you have multiple locations, offices or divisions. This can be true of online services, office supplies, hospitality supplies or services, and many other items. Consider consolidating to one vendor, and taking that opportunity to negotiate for favorable terms.

3. Efficiency

Are there products or materials where you are getting weekly shipments when monthly would do? Are you signed up for 20GB of data, but you really need 50GB and are charged an overage each month? Or vice versa? Considerable savings can be had by negotiating with the vendor.

4. Vendor Terms

Do you know the market rate for what you’re getting? Are better terms available from your current vendor or a competitor?

Do you have big contracts that are expiring or equipment that will need replacing? Are you leasing equipment or office space that may be up for renewal soon?

Tackle

You have now set yourself up to make very good decisions.

Go back and review those items where you may be able to consolidate, get better vendor terms, or change service levels. Scrub each contract. Make sure you know all the hidden costs and carve outs in each contract. Make sure you know the best available rates for your products and services.

It is also important to understand internal sensitivities. Some divisions have important reasons why they use different vendors or tools. Cost may or may not always be the overriding factor. Make sure you understand any special circumstances before you finalize your recommendations.

We have an advantage here, as we see hundreds of contracts and service agreements in nearly every category every year. We know where the tricky bits are, we know the standards and we know how to have the complex discussions with landlords and vendors that can result in very big savings.

Hidden Costs in Contracts

A useful example of this is two of our clients, an insurance group and a law firm, who have offices in the same building. When we analyzed their costs, we saw discrepancies. We could see issues in items ranging from shared space discrepancies to real estate tax issues.

We then categorized and assessed, and that’s when things became clear. Both tenants were being overcharged for a larger common area factor than architectural drawings showed, were being taxed when there was an exclusion for real estate taxes, and were being charged twice for janitorial services.

Once we identified and documented these issues, both tenants received reimbursements and rent credits from the landlord for the overpayments. The insurance group received $68,450 in reimbursement and a month of rent abatement. The law firm received a check for $128,000 and three months of rent.

More importantly, we established a process for periodic review of all of their expenses. Now they can review and reassess every year much more easily.

***

Did any of these steps give you a bit of anxiety? Don’t worry, each and every phase is something we love diving into. No matter where you are in the process, we are here to help and love brainstorming with new clients to get started.

[fusion_button link=”mailto:[email protected]” text_transform=”” title=”” target=”_self” link_attributes=”” alignment=”center” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Get Help with My Spend Analysis[/fusion_button]