What’s the news?

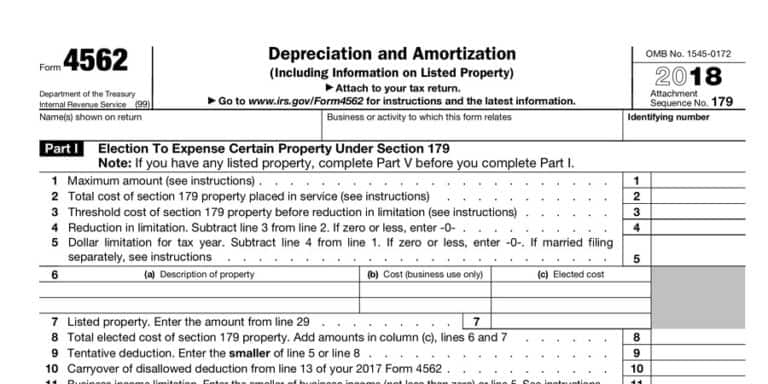

In September, the IRS and the Treasury Department finalized new depreciation rules stemming from the Tax Cuts and Jobs Act (TCJA).

There is good news here for most business owners. Last year, the major change was that most assets were depreciated in their first year of service. What’s new here is that the rest, which used to have a 39 year depreciation schedule, can now be depreciated in just 20 years.

The details:

- The 100% first-year depreciation deduction applies to:

- Most business purchases, other than buildings and real estate. This usually includes machinery, equipment, computers, appliances and furniture.

- That were acquired and put into service since September 2017.

- Large, very long term investments, such as buildings now have a 20 year depreciation period. This is almost twice as fast as the prior 39 year period.

Who does this affect?

- The TCJA will have a significant impact on tax returns for retail businesses, restaurants, hotels, and car dealerships.

- It will also affect real estate investors and properties that are waiting on technical corrections from Aug 2018.

- These corrections can be applied to qualified improvement properties (QIP) within their 39-year depreciation period.

What’s the advantage?

- The advantage is that you can now depreciate costs faster, resulting in a large, year end tax savings. This is a significant tax tool for Tax Mitigation and Wealth Preservation.

Read the full details of the new rules here.

How we can help:

You likely have tax breaks on older buildings that you don’t know exist and we want to help you find them. After we talk about your situation, we’ll survey your property assets and their qualifications and provide a detailed report showing you how those assets can be reclassified for tax benefits, saving you money annually.

If you want to take advantage of these new depreciation rules and want to see how we can find other ways to put more money in your pocket every month by reducing your business expenses, it’s only a short email away. You’ll pay zero out of pocket and we split the savings with you.

[fusion_button link=”mailto:[email protected]” text_transform=”” title=”” target=”_self” link_attributes=”” alignment=”center” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Show Me How to Pay Less Taxes[/fusion_button]